Fixed Assets Management Plug In

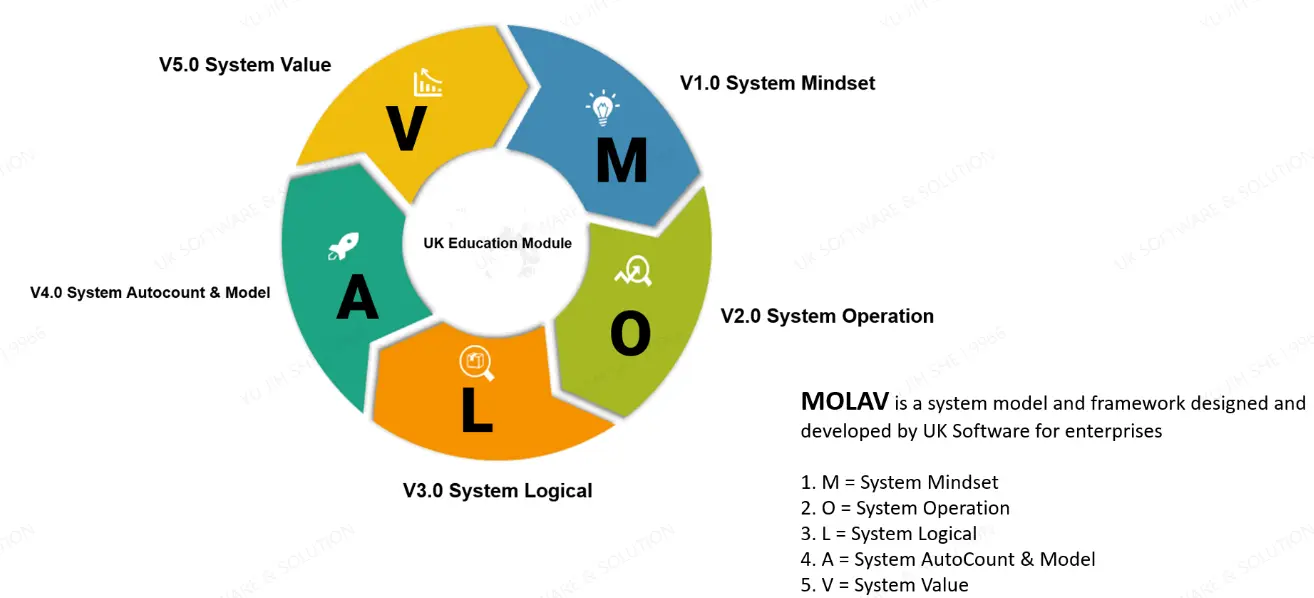

AutoCount Fixed Assets Management Plugin

In today’s fast-paced business environment, efficiently managing your fixed assets is essential for sustaining productivity and profitability.

The AutoCount Fixed Assets Management Plugin offers a comprehensive solution to help you streamline asset tracking, maintenance, and reporting. With its powerful features, you can easily monitor asset lifecycles, manage depreciation, and ensure accurate records — all within a user-friendly interface.

This tool empowers your business to save time, reduce errors, and make smarter financial decisions.

Reports & Export

- Real-time Depreciation Reports, Asset Disposal Reports, and Asset Detail Reports.

- Export to Excel for easy audit and reconciliation.

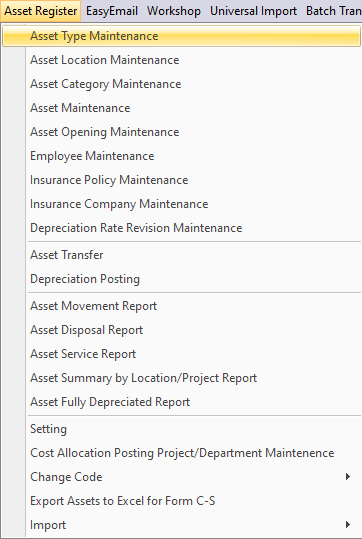

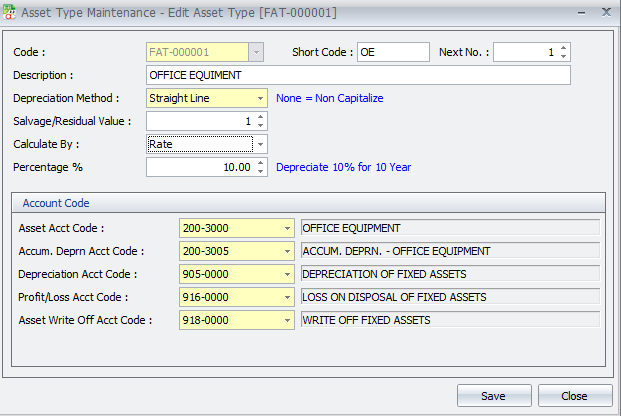

Asset Type Maintenance

- Set Once, Apply Everywhere: Predefine asset categories, depreciation methods, salvage value, and depreciation rates.

- Automatic Accounting Mapping: Asset, accumulated depreciation, depreciation expense, disposal gain/loss, and write-off accounts are auto-filled.

- Standardized Management: Ensure consistent accounting treatment for all asset types and eliminate manual variations.

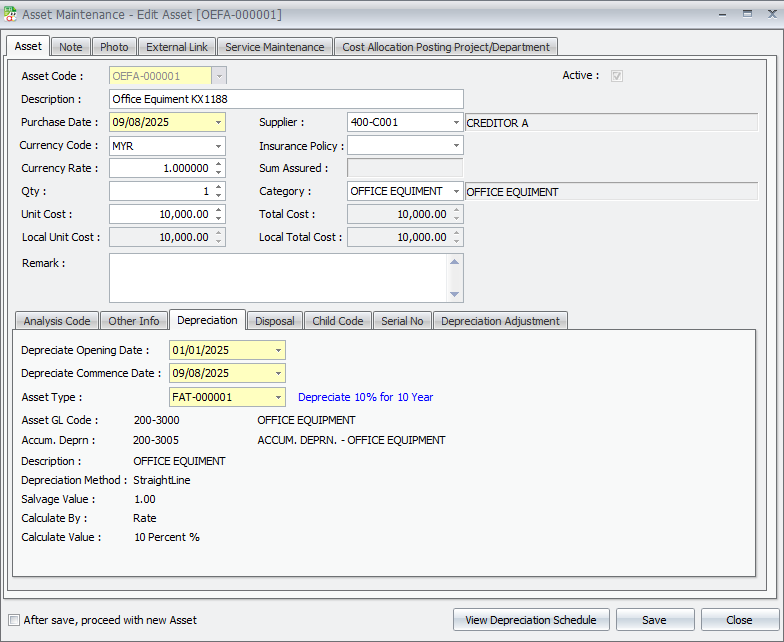

Asset Maintenance

- Comprehensive Asset Records: Purchase date, supplier, currency, quantity, price, category, insurance details.

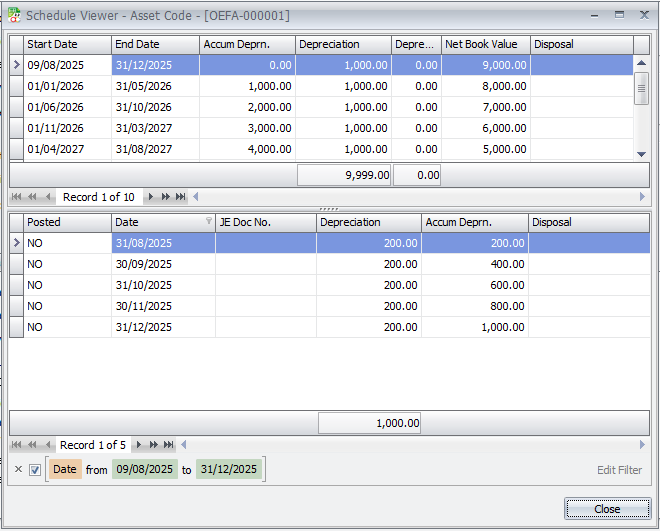

- Automated Depreciation: Generate depreciation schedules based on predefined settings with the option to view the full schedule.

- Full Lifecycle Tracking: Includes maintenance records, serial number tracking, sub-assets, and disposal/write-off processes.

- Cost Allocation: Accurately distribute asset costs to projects or departments.

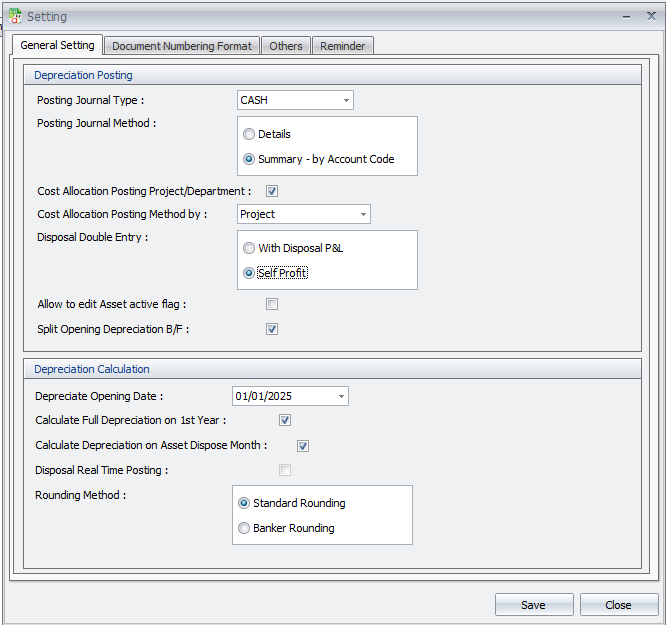

Asset Setting

Depreciation Posting

- Flexible Posting Journal Types: Choose from multiple journal types, e.g., CASH.

-

Posting Journal Method:

- Details – post each entry individually for detailed tracking.

- Summary – by Account Code – post in summarized form for cleaner ledgers.

- Cost Allocation by Project/Department: Assign depreciation costs directly to the right project or department.

- Double Entry Options: Choose whether disposal postings include Profit & Loss or self-profit allocation.

- User Permissions: Control whether asset active status can be edited.

Depreciation Calculation

- Flexible Start Dates: Set depreciation opening dates precisely (e.g., 01/01/2025).

- Full-Year Depreciation Option: Calculate the full year’s depreciation in the first year if required.

- Month-Specific Calculations: Automatically calculate depreciation for the asset disposal month.

- Real-Time Disposal Posting: Ensure immediate updates upon asset disposal.

- Rounding Options: Choose Standard Rounding or Banker Rounding to align with accounting practices.

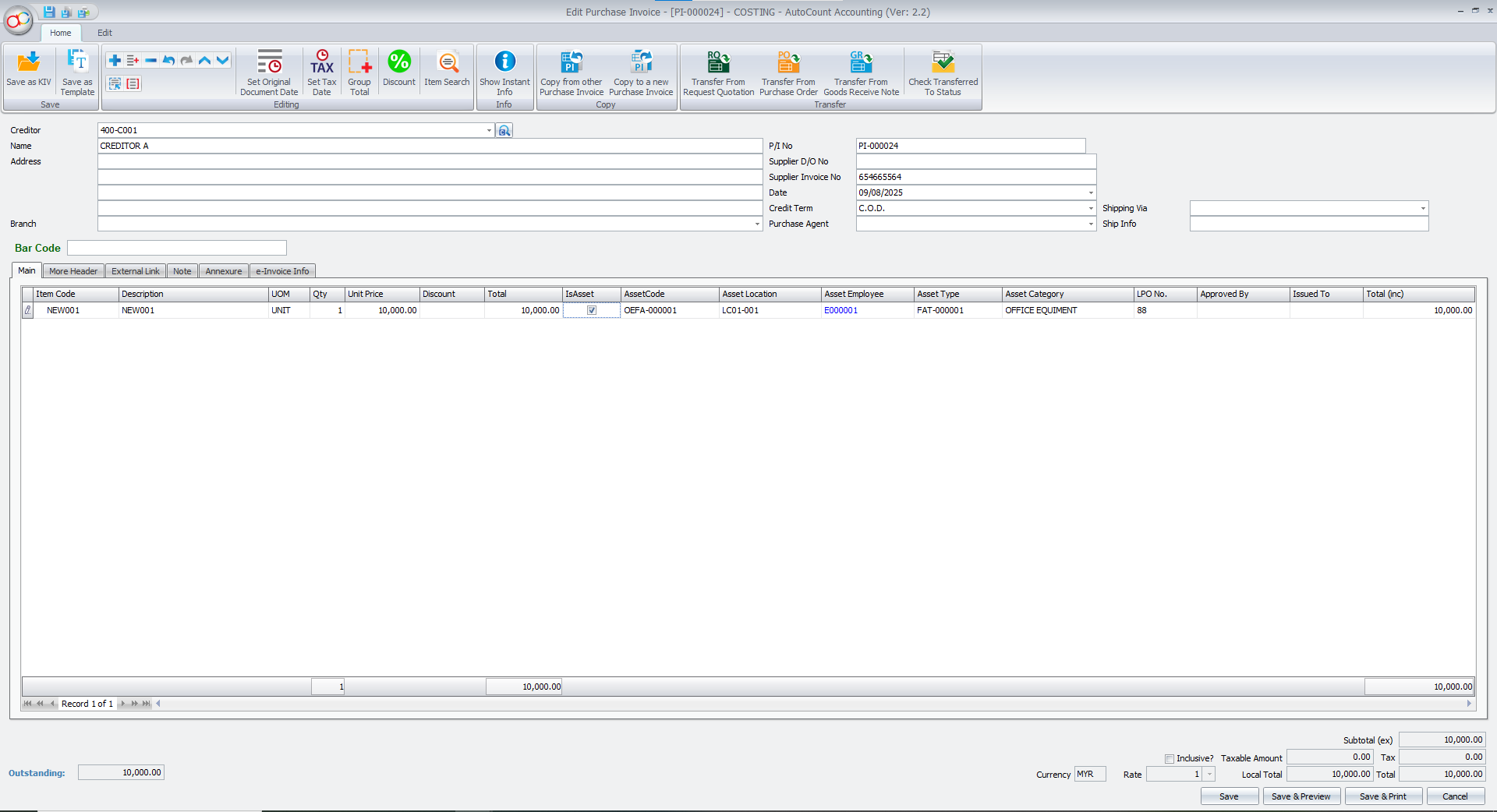

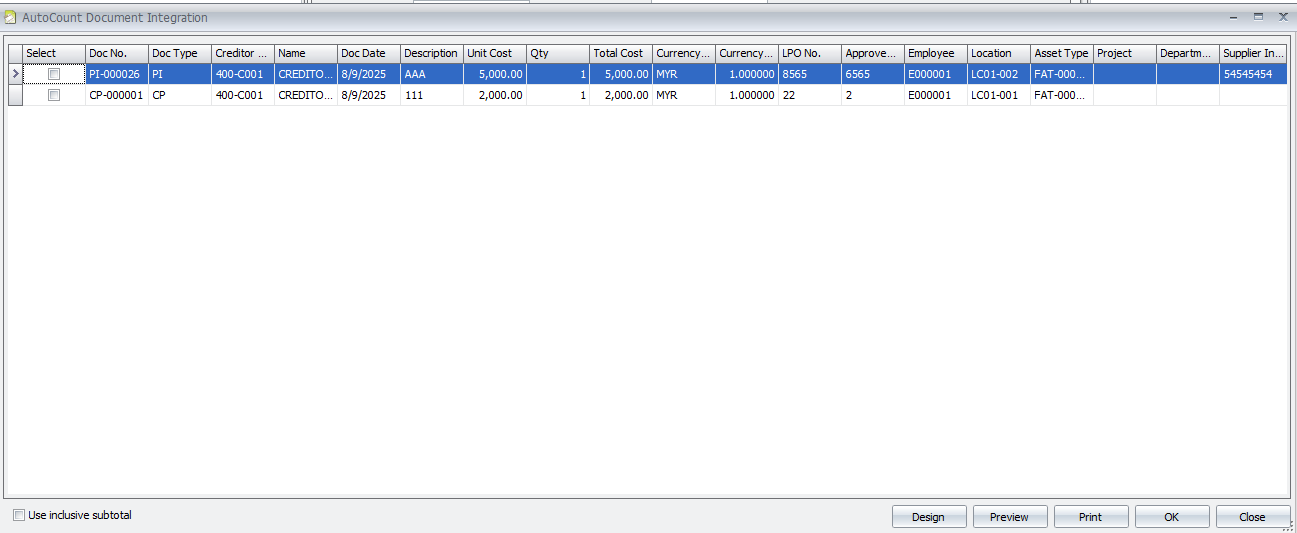

Document Integration Support Transfer From Purchase Module

Turn purchases into fixed assets in one step. The AutoCount Fixed Assets Management Plugin integrates directly with Purchase documents so your team avoids double entry and accounting mismatches.

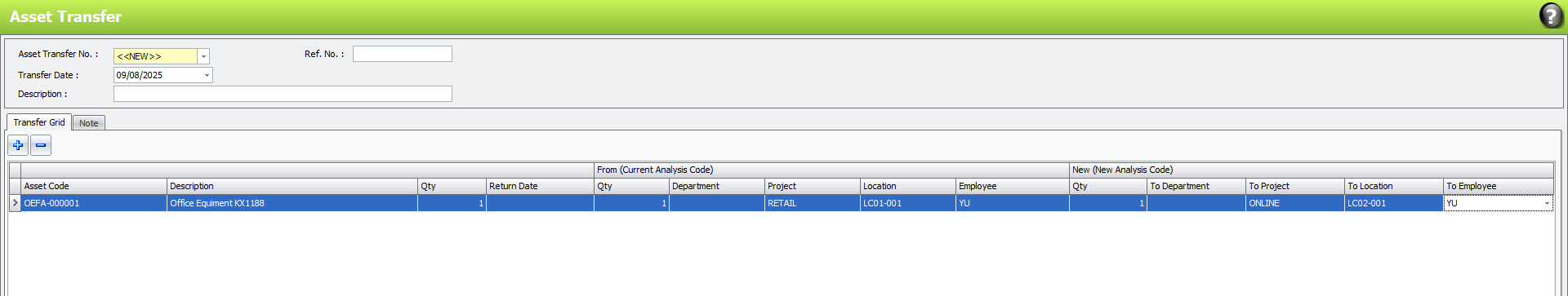

Fixed Assets Transfer

Seamless Movement Tracking

In dynamic business operations, assets often need to move between locations, departments, or projects. The AutoCount Fixed Assets Management Plugin makes transfers effortless while maintaining a full audit trail.