Introduction to SST in Malaysia

What is SST (Sales and Service Tax)?

SST is a consumption tax system reintroduced in Malaysia in 2018, replacing the previous GST (Goods and Services Tax). SST consists of two main components:

- Sales Tax: Imposed on manufacturers or importers when selling goods. The standard rate is 5% or 10%, with specific rates for certain products.

- Service Tax: Charged on selected service providers (e.g., restaurants, hotels, professional services), typically at a rate of 6%.

Key Features of SST

Single-tier tax system – Tax is only applied at specific points in the supply chain

Clearly defined applicable sectors – Covers manufacturing, importing, services, F&B, etc.

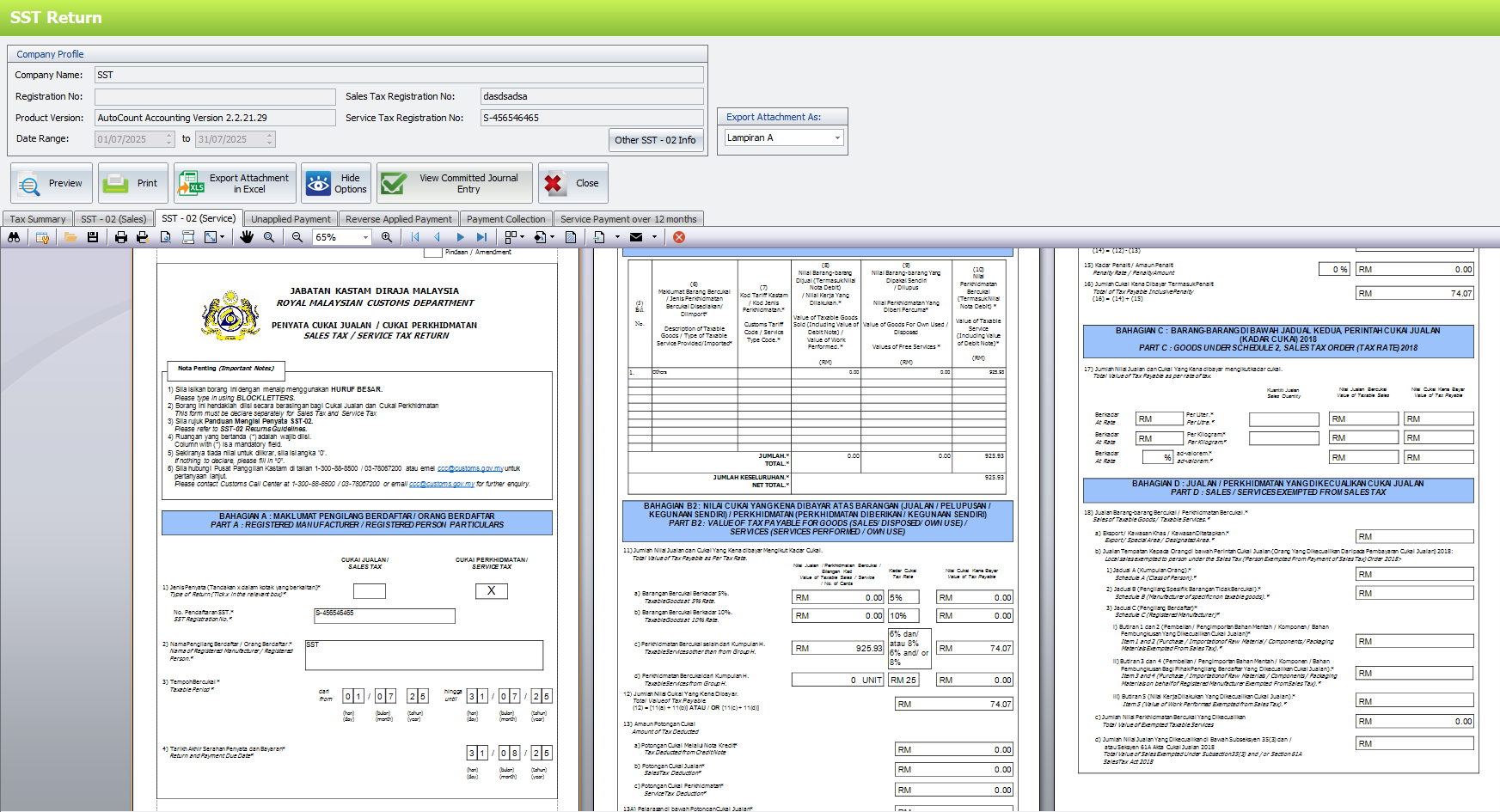

Bi-monthly submission cycle (every two months)

Monitored and submitted via Royal Malaysian Customs Department

Guide On Transitional Rules ( 5th Sep 2018 )

How is SST Different from GST?

| Category | SST | GST |

|---|

| Tax Structure | Single-tier | Multi-tier |

| Implementation | Since September 2018 | 2015 to 2018 |

| Tax Rates | Sales Tax 5% 10% Service Tax 6% 8% | Standard rate 6% |

| Filing Method | Manual submission via SST-02 | Online submission |

Service Tax VS Sales Tax

| Comparison Category | Service Tax | Sales Tax |

| Applicable To | Service industries (hotels, restaurants, IT, etc.) | Manufactured or imported goods |

| Taxation Stage | Taxed when service is provided to customers | Taxed at manufacturing/import level |

| Tax Rate | Usually 6%, 8% | 5%, 10%, or special rates |

| Invoicing & Submission | Tax shown on invoice; SST-02; by service provider | Tax included in price; SST-02; by manufacturer/importer |

| Practical Examples | Restaurants, IT services (6%) | Factories, imported goods (e.g. 10%) |

| Accounting Basis | Payment Basic | Accrual Basis |

Who Needs to Register for SST?

According to the Royal Malaysian Customs Department, businesses that exceed the annual turnover threshold are required to register for SST, including:

- Manufacturers or Importers (Sales Tax)

- Service providers of taxable services (Service Tax), such as accounting firms, restaurants, salons, car workshops, etc.

Once registered, the business will be issued an SST registration number and must submit SST-02 returns every two taxable months.

Register Link

How Can We Help You?

We provide professional accounting systems and solutions that fully support SST return generation, Sales & Service Tax calculations, tax code classifications, and more — helping your business stay compliant, efficient, and stress-free.

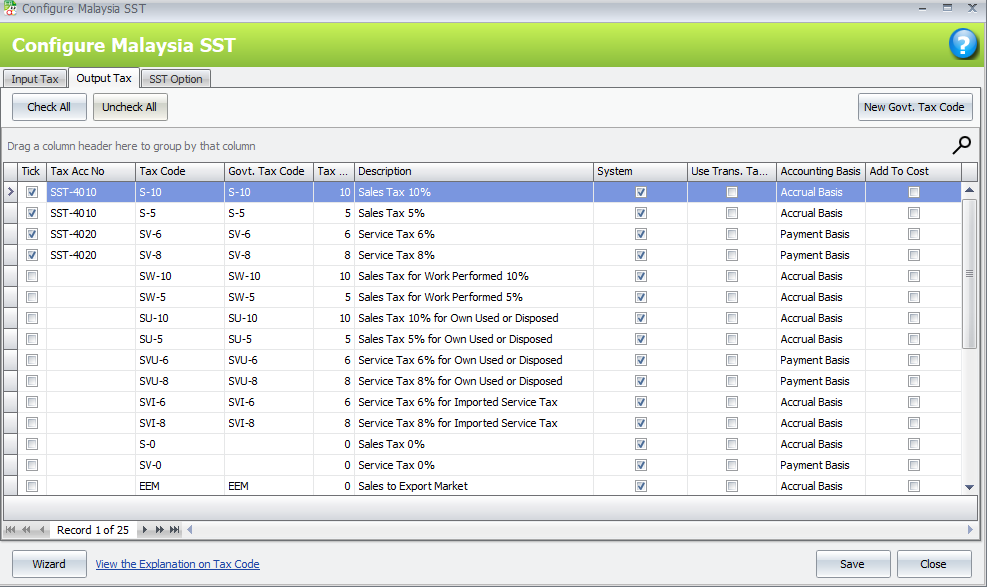

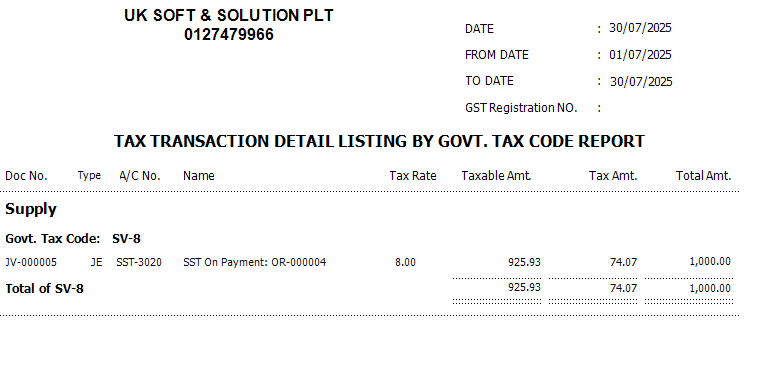

AutoCount Malaysia SST Features Overview

AutoCount provides a complete Sales and Service Tax (SST) solution for Malaysia, fully compliant with the Royal Malaysian Customs requirements, while simplifying setup and reporting for users.

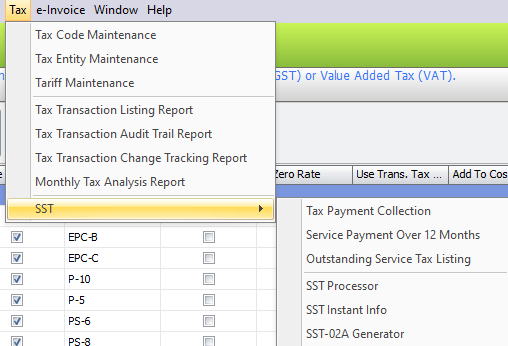

Comprehensive SST Menu

From the main AutoCount interface, users can access all SST-related features via SST including:

- Tax Code Maintenance

- Tax Entity / Tariff Maintenance

- SST Processor / SST-02A Generator

- Service & Sales Tax Reports

SST Return

SST e Learning Course