马来西亚 SST 简介

什么是 SST(Sales and Service Tax)?

SST 是马来西亚自 2018 年起重新实施的消费税制度,取代原有的 GST(Goods and Services Tax)。SST 分为两大部分:

- Sales Tax(销售税):对制造商或进口商在销售货品时征收,税率通常为 5% 或 10%,部分特定商品为特定税率。

- Service Tax(服务税):针对特定行业(如餐饮、酒店、专业服务等)提供服务时征收,标准税率为 6%。

SST 的主要特点

单层税制:只在销售链中的特定环节征税

适用行业范围明确:涵盖制造、进口、餐饮、服务等领域

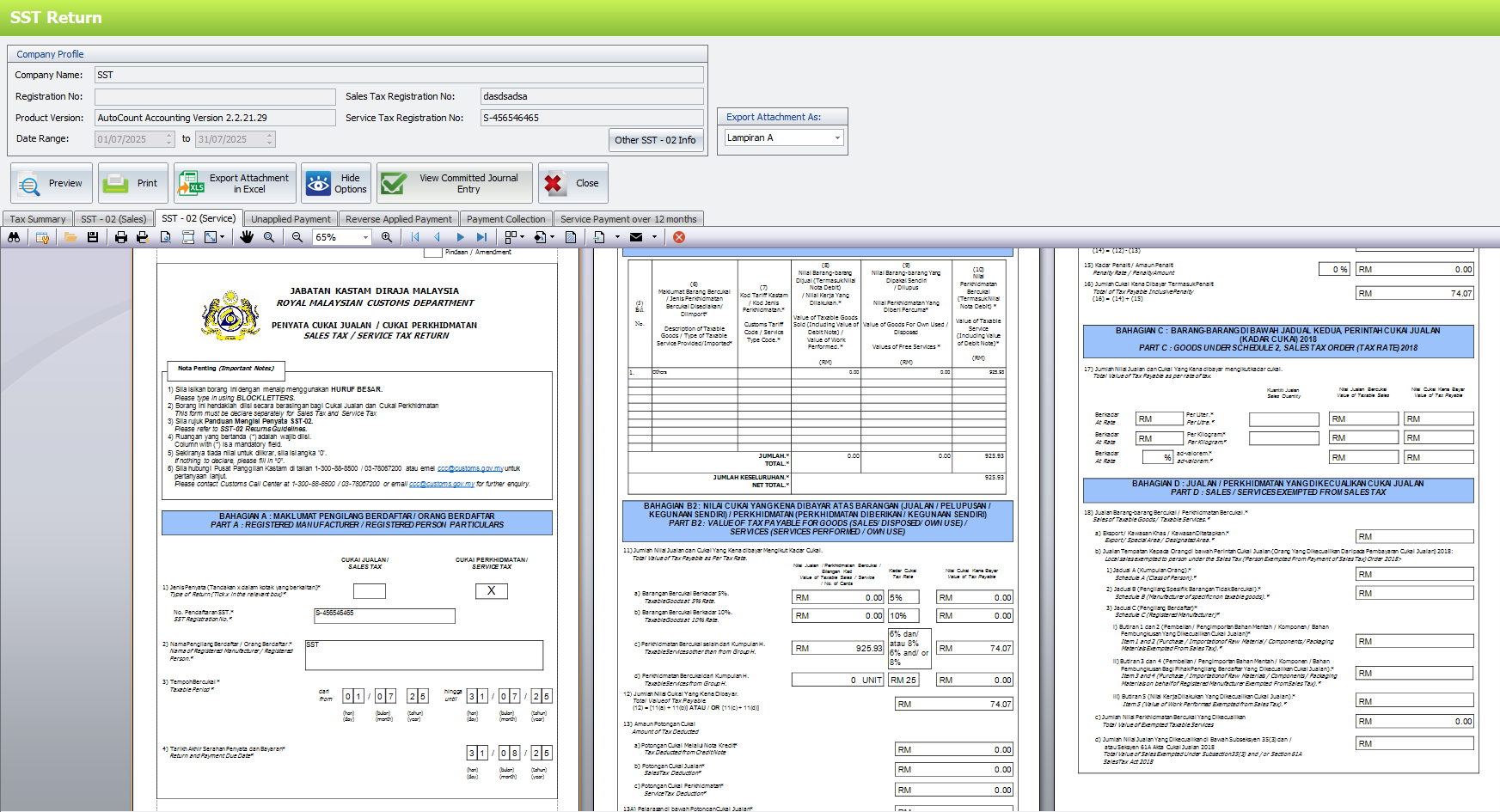

税务申报周期为双月(每两个月一次)

通过马来西亚关税局(Customs)监管和申报

Guide On Transitional Rules ( 5th Sep 2018 )

SST 与 GST 有何不同?

| Category | SST | GST |

|---|

| 税制类型 | 单层税 | 多层税 |

| 起始实施时间 | 2018 年 9 月 | 2015 年至 2018 年 |

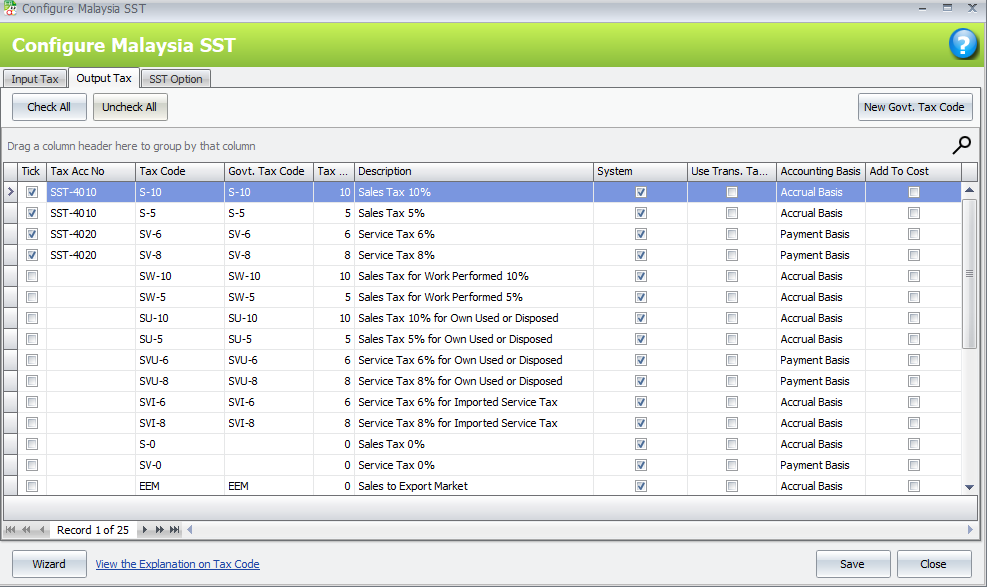

| 税率 | Sales Tax 5% 10% Service Tax 6% 8% | 标准税率 6% |

| 报税方式 | 在线申报、提交 SST-02 | 在线申报 |

Service Tax VS Sales Tax

| Comparison Category | Service Tax | Sales Tax |

| Applicable To | Service industries (hotels, restaurants, IT, etc.) | Manufactured or imported goods |

| Taxation Stage | Taxed when service is provided to customers | Taxed at manufacturing/import level |

| Tax Rate | Usually 6%, 8% | 5%, 10%, or special rates |

| Invoicing & Submission | Tax shown on invoice; SST-02; by service provider | Tax included in price; SST-02; by manufacturer/importer |

| Practical Examples | Restaurants, IT services (6%) | Factories, imported goods (e.g. 10%) |

| Accounting Basis | Payment Basic | Accrual Basis |

谁需要注册 SST?

根据马来西亚关税局规定,以下企业若年收入达到门槛,需强制注册 SST:

- 制造商或进口商(销售税)

- 提供受控服务的公司(服务税),如会计师事务所、餐馆、美容院、汽车维修等

注册成功后,企业将获得 SST 注册编号,并须在每两个课税月份内提交 SST-02 报表。

Register Link

我们如何协助您?

我们提供专业的会计系统和解决方案,全面支援 SST 报表生成、销售税与服务税计算、产品税务分类设定等,确保您的业务 合规无忧、高效运作。

AutoCount Malaysia SST Features Overview

AutoCount provides a complete Sales and Service Tax (SST) solution for Malaysia, fully compliant with the Royal Malaysian Customs requirements, while simplifying setup and reporting for users.

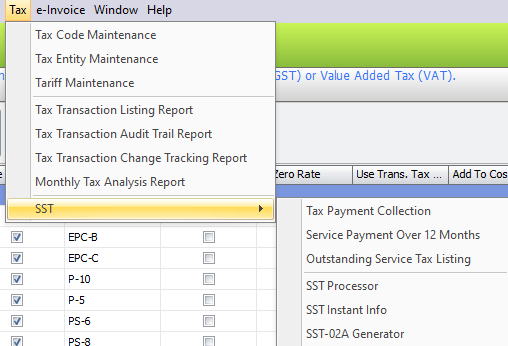

Comprehensive SST Menu

From the main AutoCount interface, users can access all SST-related features via SST including:

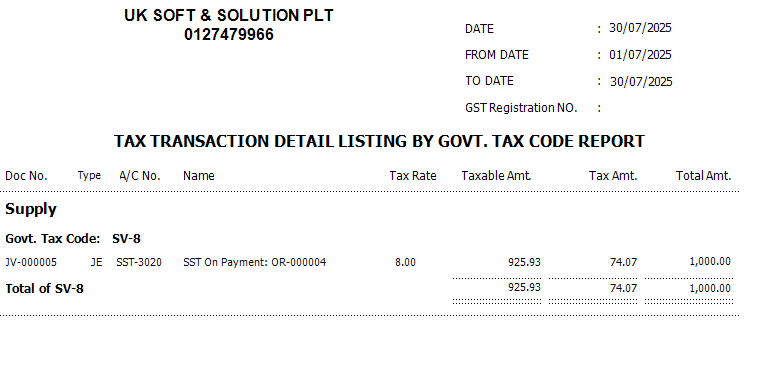

- Tax Code Maintenance

- Tax Entity / Tariff Maintenance

- SST Processor / SST-02A Generator

- Service & Sales Tax Reports

SST Return

SST e Learning Course